We use Cookies. Read our Terms

- News

- “We are all trying to rebound”: TDB on the record

“We are all trying to rebound”: TDB on the record

The future of trade finance in Africa and how to close the US$100 billion finance gap

When it comes to global trade, the playing field is far from even. According to UN Trade and Development (UNCTAD), trade between European countries accounts for more than two-thirds (68 percent) of all trade across the continent. In Asia the figure is close to 60 percent while in Latin America and the Caribbean it is around 20 percent. But across Africa barely one-sixth of all trade (16 percent) stays within the region.

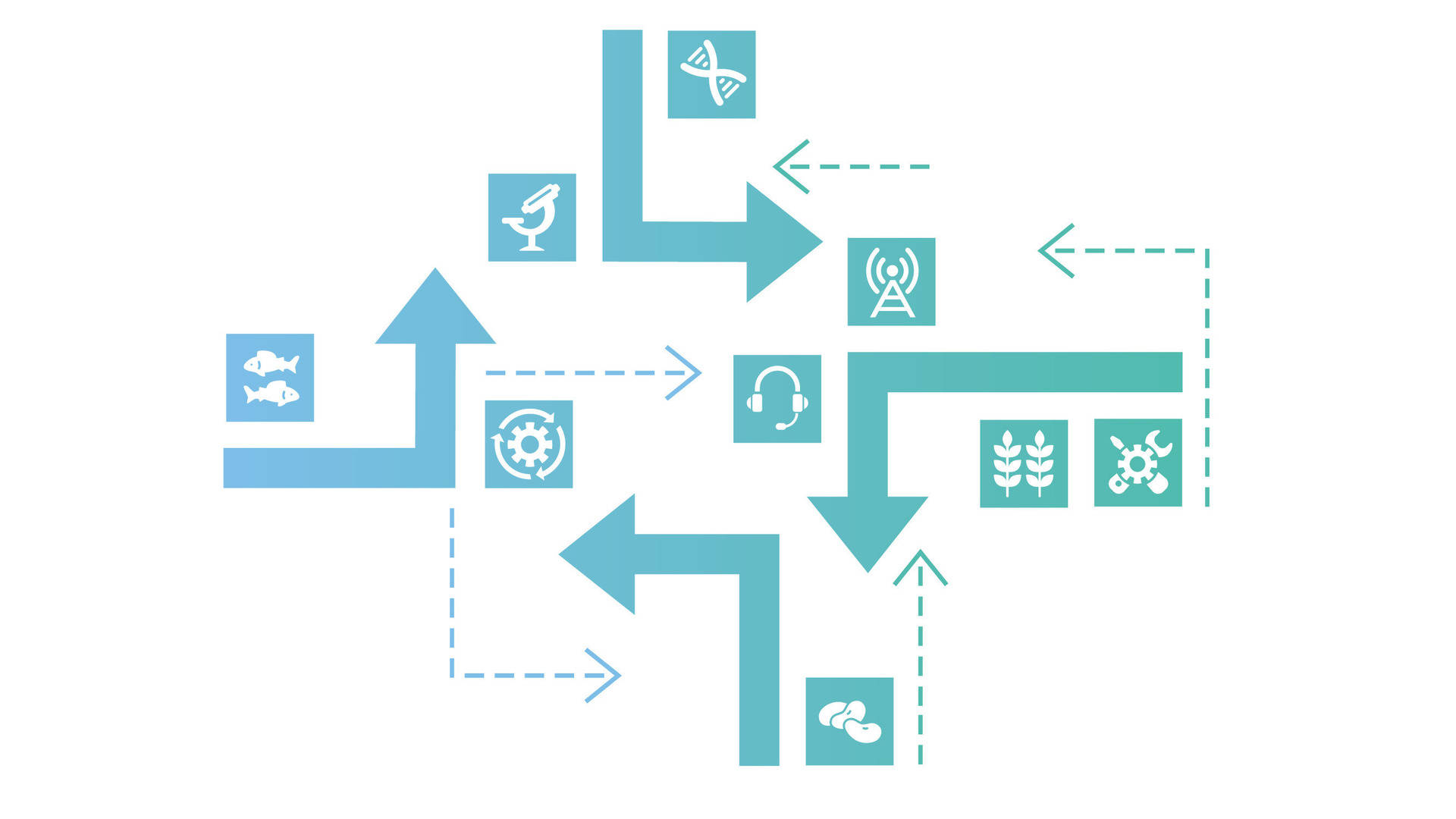

There are many reasons for this disparity. First, most African exports are primary goods, which limits the options for intra-continental trade. At the same time African countries face high trade costs, complex regulatory environments and generally poor infrastructure (including lack of processing facilities for the above-mentioned raw materials). All of which makes trade flows between African nations both expensive and inefficient. Initiatives like the African Continental Free Trade Area – established in 2018 and ratified by 47 of 54 signatory countries – aim to reduce tariffs and promote deeper economic integration. Meanwhile, more flexible funding from development finance institutions (DFIs) is easing the liquidity needs of small and medium-sized enterprises (SMEs), allowing them to join the global trade arena.

But with Africa’s trade finance gap put at between US$80 and US$120 billion, will such measures ever be enough? To find out more we spoke with Admassu Tadesse, President and Managing Director of the Eastern and Southern African Trade and Development Bank Group (TDB), who in May 2024 was named “African Banker of the Year” on the sidelines of the African Development Bank Annual Meetings in Nairobi.

OPEC Fund Quarterly: What are the most recent and significant market developments from TDB Group’s perspective?

Admassu Tadesse: The market of trade finance, project finance and development finance has gone through some “dynamics” in recent years – and this is a period of recovery. We are all trying to rebound. Multilaterals like TDB Group and the OPEC Fund are expected to be counter-

cyclical in periods of macroeconomic turbulence. So when commercial financiers shy away, we’re expected to firm up and step up.

At TDB Group we’ve continued to provide essential financial services to member states, for both private and public clients, to ensure that there’s continued security of supply of essential commodities. It could be fertilizer for agriculture and food security; or fuel for energy security; or pharmaceuticals, among others.

The market continues to show strong demand, but there are still many challenges linked to the stress caused by the COVID-19 pandemic and new geopolitical crises. At the same time the macroeconomic environment hasn’t been helpful as interest rates and inflation are still quite high, and debt sustainability issues, prevalent. That’s taken its toll on many clients who typically have floating rates. So overall, there’s a lot of demand for financing, but also a lot of stress and constraints.

OFQ: What new products are you preparing to mobilize new funding? What opportunities do you see on the horizon?

AT: TDB Group continues to be a growth-orientated DFI and our balance sheet has just crossed the US$10 billion mark. We’re working with many strategic partners, expanding our offerings while targeting specific sub-segments in development finance, especially around renewable energy, but also looking deeper at off-grid and small-grid solutions.

We’re also looking at innovation in technical assistance and project preparation, moving upstream from where we’d normally engage only at the financing level. That requires more risk appetite and suitable funding. In this regard, we have put in place a special purpose vehicle in the form of the Trade and Development Fund. Here we’re looking for partners to provide more concessional financing to help blend with projects that need to take off.

We also have an asset management platform, a trade finance fund and a green housing value chain fund, among others. These are all new offerings we’re looking to expand with strategic partners like the World Bank Group, which has become a very strong partner. We look forward to others joining in those initiatives, notably the OPEC Fund as one of our strategic partners.

OFQ: Compared to commercial banks, what is the regional role of a DFI like TDB Group? Is that role likely to change and evolve over the next decade?

AT: We’re naturally sustainably-orientated with the classic triple bottom-line dimensions of financial, environmental and social sustainability. We complement markets, often working closely with commercial banks but also go where commercial banks wouldn’t normally go. So we address market failures, but at the same time crowd in private capital where we can.

Commercial banks have always been strong partners for TDB Group, but there are challenges with risk taking. Many international commercial banks have retreated from several of our frontier markets, notably those that have typically provided acceptable letters of credit for trade purposes.

The regulatory environment has become very strict and onerous in many ways. So we’ve had to step in and do more to ensure that gaps are covered as much as possible. The gap in trade finance is well over US$100 billion per annum in Africa. As a US$10 billion institution, we have quite a bit of leverage but it’s still very short of filling that big gap.

OFQ: In which sectors and regions are we seeing retreats?

AT: It’s mostly in sub-Saharan Africa, in pockets of eastern, western and southern Africa. But there’s been a systemic retreat for several years. Access to finance has always been an issue in Africa and frontier markets – and it doesn’t help when global governance standards become so overly strict that they become a serious constraint. A lot of commercial banks would rather not take such risks. It has a way of dampening risk appetite.

OFQ: On the flip side, can you tell us more about the expansion of TDB Group across Africa?

AT: We’re operating in a context where the continent is integrating. We have the African Continental Free Trade Area, where we’re moving more and more towards a common market approach. In that context, we’re looking to play more of a role in centers that we feel have a lot to offer in terms of trading with different parts of the continent. We’ve stepped into Senegal, Ghana and Botswana and we’re getting ready for other significant economies. We have our core markets, of course, but we also understand that connectivity adds value to our existing markets.

OFQ: How important is the OPEC Fund’s partnership with TDB Group? How have our equity investments and funding boosted your work?

AT: We’re very pleased with our strategic partnership with the OPEC Fund over the last decade, although our broader relationship goes much further back. The risk capital space has been valuable to us because we need to multiply our funding and leverage our existing capital. Scale and appetite are important and thanks to our strategic partnership with the OPEC Fund we’ve been able to boost our offering to our clients and markets.

OFQ: How are you enabling South-South trade? Beyond financing fertilizer imports from Morocco to Ethiopia, what can you share of your work?

AT: We’ve long focused on strategic sectors like agriculture and energy security, where we’ve promoted linkages between different African countries. Morocco is a key global African player when it comes to fertilizers, so we supported their exports to the rest of Africa with hundreds of millions of dollars of related trade financing, including via blockchain technology to optimize those transactions in terms of time, cost and carbon footprint.

We’re also working with many partner countries in the Gulf like Saudi Arabia and the United Arab Emirates, which are very close to the African continent. So we’ve thrown our weight behind the trade between those economies and markets within our member states.

OFQ: What are your experiences of risk mitigation and risk transfer, especially when working with partners such as insurance companies?

AT: We’ve always seen ourselves as a “rainmaker” by having larger facilities than just what we ourselves can contribute. We co-finance a great deal and try to crowd in as many risk-sharing partners as possible, so we can do more than just conventional balance sheet-based financing.

We have a long track record with Lloyds of London as one particular stakeholder group, but the World Bank Group’s Multilateral Investment Guarantee Agency (MIGA) has also been a strong strategic partner in recent years. They’re enabling us to scale up and do more in an environment that continues to be characterized by shocks of all kinds, including rapid rises in interest rates that make the cost of access to finance very difficult.

The Arab Bank for Economic Development in Africa (BADEA) and British International Investment are two of our partners, among several others, that have stepped in and worked with us on risk sharing, both on a funded and unfunded basis, which enables us to do much more.

Admassu Tadesse

Admassu Tadesse has been Trade and Development Bank (TDB) Group President and Managing Director since 2022. Prior, he led PTA Bank and its evolution into TDB, as well as serving as Executive Vice President for International Finance and Corporate Strategy with the Development Bank of Southern Africa. Under his leadership, TDB Group has expanded into several new and under-served markets, with total assets growing about 10-fold to US$10 billion in 2023.