We use Cookies. Read our Terms

- News

- The OPEC Fund and renewable energy

The OPEC Fund and renewable energy

As published in the 01/2020 issue of the OPEC Fund Quarterly

A word from OPEC Fund Director-General Dr Abdulhamid Alkhalifa

Energy is at the heart of the social, economic and environmental challenges – and opportunities – facing the world today.

Renewables play a key role in the energy supplies of both developed and developing countries. While progress has been made in the uptake of renewables, energy efficiency and energy access, the world is still behind when it comes to meeting the targets of the Paris Agreement or of SDG 7 on access to clean modern energy for all.

To support faster transition to renewable sources of energy, the OPEC Fund continues to commit more financing to both public and private sector renewables projects, technical assistance and grants, and engages in policy dialogue with all energy market stakeholders.”

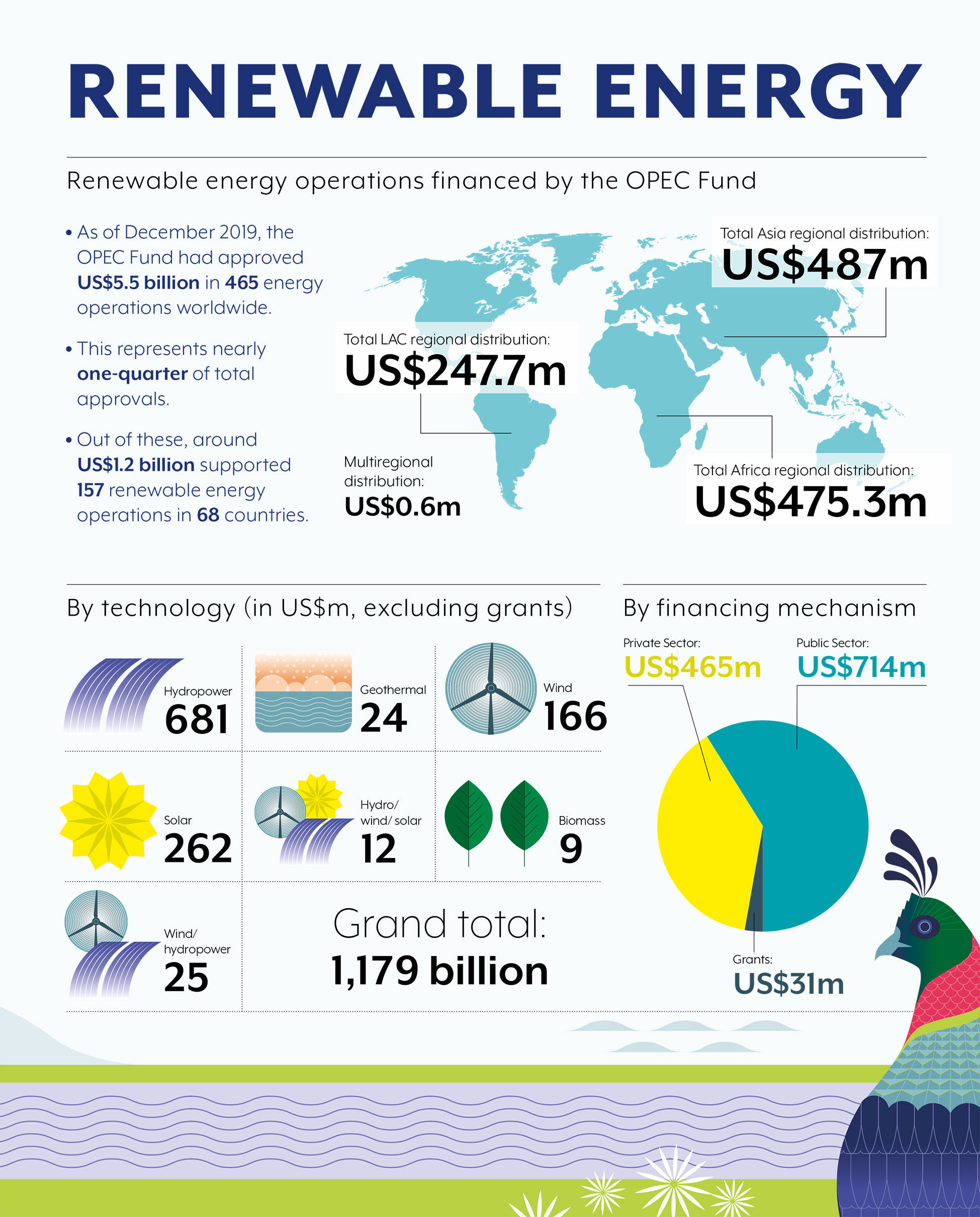

Africa

Regional distribution: US$475.3 million

(Recent examples only)

Boulanouar Wind Farm in Mauritania

OPEC Fund financing: US$18 million (public sector)

Total project cost: US$143.7 million

Approved: July 2017

Co-financiers: Arab Fund, government of Mauritania

Boulanouar is the largest wind farm in Mauritania with a capacity to generate 102 MW. The construction of the 39-turbine wind farm was co-financed by the OPEC Fund with a US$18 million loan in 2017. The project is expected to reinforce energy supply to the cities of Nouakchott and Nouadhibou as well as helping Mauritania meet its growing domestic demands and produce a surplus that can be exported.

Access to Sustainable Energy Services in Mali, Niger and Senegal

OPEC Fund financing: US$0.9 million (grant)

Total project cost: US$10.5 million

Approved: September 2018

Co-financiers: DG DEVCO, Plan International

The project aims to enhance access to affordable and reliable modern energy services and promote the productive uses of energy for income-generation in rural areas of Mali, Niger and Senegal. Its specific objective is to provide access to Renewable Energy (RE) Services to rural SMEs run by women and encourage the uptake of RE-related income generating activities.

Nachtigal Hydro Power Company (NHPC) in Cameroon

OPEC Fund financing: €50 million (private sector)

Total project cost: €1.2 billion

Approved: March 2018

Co-financiers: AFC, AFD, AfDB, BICEC, CDC, DEG, EAIF, EIB,FMO, IFC, Proparco, SCB Cameroun, Societe Generale Cameroun, Standard Chartered Bank Cameroon S.A.

In January 2019, the OPEC Fund signed a term loan of up to €50 million with Nachtigal Hydropower Company (NHPC) for the development, construction and operation of a 420 MW hydropower plant in Cameroon. Deemed high priority by the government of Cameroon, the plant, once in operation, will be the country’s largest generator of electricity, meeting about one-third of the nation’s electricity needs. The project is at the heart of Cameroon’s Electricity Sector Development Plan.

Once in operation, the new plant will be Cameroon's largest generator of electricity.

Asia

Regional distribution: US$487 million

(recent examples only)

Seven Sisters

OPEC Fund financing: US$24 million (private sector)

Total project cost: US$118 million

Approved: September 2014

Co-financiers: Arab Bank, Europe Arab Bank, Finnfund, FMO, IFC

Jordan’s ‘Seven Sisters’ are a group of seven solar PV projects and part of the renewable energy program launched by the government of Jordan in 2011. The project included 12 solar power plants. To overcome the relatively small scale of each individual project, the IFC proposed a novel solution: aggregating the first seven of these 12 projects into a single financing program, with a simplified and standardized financing structure. The OPEC Fund contributed US$24 million to two projects. The Seven Sisters added further generation capacity and stimulated the build-out of ancillary infrastructure and follow on investments – in Jordan and in other countries.

Baynouna Solar PV Project

OPEC Fund Financing: US$17 million (private sector)

Total project cost: US$235 million

Approved: December 2017

Co-financiers: DEG, Europe Arab Bank, FMO, ICA , JIFC

The 248 MW Baynouna Solar Energy Project, built 10 km outside of the capital Amman, is Jordan’s largest solar PV plant and one of the biggest in the whole of the Middle East. The solar energy plant will supply approximately 160,000 homes while displacing an estimated 360,000 tons of CO2 annually, the equivalent of taking nearly 80,000 cars off the roads.

Nepal Water and Energy Development Company (NWEDC)

OPEC Fund financing: US$13.8 million (private sector)

Total project cost: US$647 million

Approved: March 2019

Co-financiers: ADB, AIIB, CDC, FMO, IFC, KDB, K-Exim, Proparco

The OPEC Fund contributed more than US$13 million for the construction of a landmark hydroelectric plant in central Nepal. With eight other lenders, this is one of the largest foreign direct investments in Nepal’s history. NWEDC will build and operate a 216 MW run-of-the-river hydroelectric plant on Trishuli River. Located some 70 km from Nepal’s capital city Kathmandu, the hydropower plant is expected to increase Nepal’s electricity supply by one-third from today’s levels and provide clean, reliable power to nine million of Nepal’s residents.

Neelum Jhelum Hydropower Plant Project in Pakistan

OPEC Fund financing: US$31 million and US$50 million (public sector)

Total project cost: US$2.8 billion

Approved: 2009 and 2012

Co-financiers: ADFD, Exim Bank of China, IsDB, Government of Pakistan, KFAED, SFD

Two loans were extended by the OPEC Fund in support of this operation for the construction of a 969 MW power plant in the Muzaffarabad district, populated by around 1.5 million people. The project is helping to improve the efficiency of social services – such as schools, healthcare facilities and water supply facilities – as well as encouraging the development of local industries. The new plant will help reduce the cost of energy for newly connected households and farms.

Latin America and the Caribbean

Regional distribution: US$247.7 million

(recent examples only)

San Marcos Wind Farm

OPEC Fund financing: US$15 million (private sector)

Total project cost: US$170 million

Approved: September 2013

Co-financiers: FMO, ICCF, DEG, Proparco

San Marcos Wind Farm expansion

OPEC Fund financing: US$5 million

Total project cost: US$25.3 million

Approved: March 2017

Co-financiers: DEG, FMO, Proparco

In 2013, the OPEC Fund supported the construction of the San Marcos wind farm in Honduras with a US$15 million loan. The 50 MW wind power facility is located in the municipality of San Marcos de Colón, 140 km south of the Honduran capital Tegucigalpa and close to the border with Nicaragua. Completed in 2015, the San Marcos Wind Farm replaced ageing and inefficient plants and helped reduce energy imports. In 2017, the OPEC Fund extended a second loan for this project in the amount of US$5 million to help finance an additional 13.2 MW. The expansion is expected to increase the annual energy production by up to seven percent.

Grant funding for renewable energy projects (in 2018) included:

Mlinda Foundation: To enhance access to energy services for some 21,000 people in 41 villages in India by installing mini-grids including photovoltaic energy. Also, capacity building helped improve farm productivity / provision of energy-efficient appliances such as irrigation pumps.

Solar Powered Smart Grids in Haiti: Brownfield Launch and Model Development – to build a 95 KW solar smart grid that will serve 500 homes and businesses with 24/7 electricity in a small fishing town in the southern peninsula. Customers, energy vendors and grid managers will interact with the grid through a utility interface that enables pre-payment billing, load management and theft detection to ensure efficient operations. The grid was successfully launched, marking a major step in mainstreaming microgrid power in Haiti.