We use Cookies. Read our Terms

- News

- OPEC Fund and the Private Sector

OPEC Fund and the Private Sector

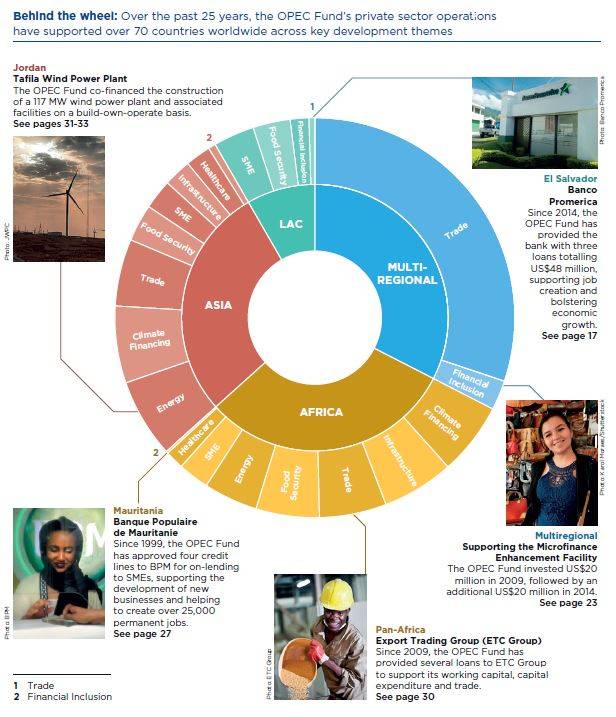

The OPEC Fund launched its private sector operations in 1998, with its first transaction in 1999, complementing its long-standing engagement with the public sector in its partner countries. While public sector operations often aim to create the infrastructure and enable an environment for a successful economy, it is the private sector that produces and trades essential goods and services. The private sector drives economic growth, the generation of employment and the creation of wealth.

Support to the private sector perfectly complements the OPEC Fund’s development mandate. Trade finance provides essential funding to keep the wheels of the global economy turning and allows importers and exporters to benefit from the advantages of mutual exchange and burden-sharing.

To date, the OPEC Fund’s investments in the private sector have directly boosted the economies of more than 70 countries globally through funding. The OPEC Fund has committed over US$10 billion to over 600 transactions across multiple sectors and geographies. Since the start of the trade finance window in 2006, the OPEC Fund has provided over 11,000 unfunded guarantees globally for more than US$12 billion.

Banco Promerica El Salvador

Country: El Salvador

Type: Financial Institution

First transaction: 2014

The OPEC Fund has supported Banco Promerica’s activities, particularly focusing on on-lending to small and medium-sized enterprises and addressing the demand for short-, medium and long-term financing.

The OPEC Fund has provided the bank with three loans totalling US$48 million, supporting job creation and bolstering economic growth. Banco Promerica has extended its support to SMEs in various economic sectors, including manufacturing, agribusiness and commercial services.